ny estate tax exemption 2022

As a result affluent. 12060000 GST tax exemption and a 40.

State Taxes On Capital Gains Center On Budget And Policy Priorities

The Tax Cuts and Jobs Act TCJA doubled the federal gift estate and generation-skipping transfer GST tax exemptions to 114 million per person in 2019.

. Estate Tax Exemption Amount Goes Up For 2022. This is an increase from 1170000000 for 2021. Walmart ppto accrual rate 2022.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. For 2022 the increased transfer tax exemptions are as follows. For 2018 2019 2020 and 2021 the annual exclusion is 15000.

Effective January 1 2022 the Federal Estate Tax Exemption is 1206000000 per person through December 31 2025. The estate includes any real or tangible property located in New York State and. The exclusion amount is for 2022 is 1206.

Effective January 1 2026 the Federal Estate Tax. The New York estate tax is a tax on the transfer of assets after someone dies. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy.

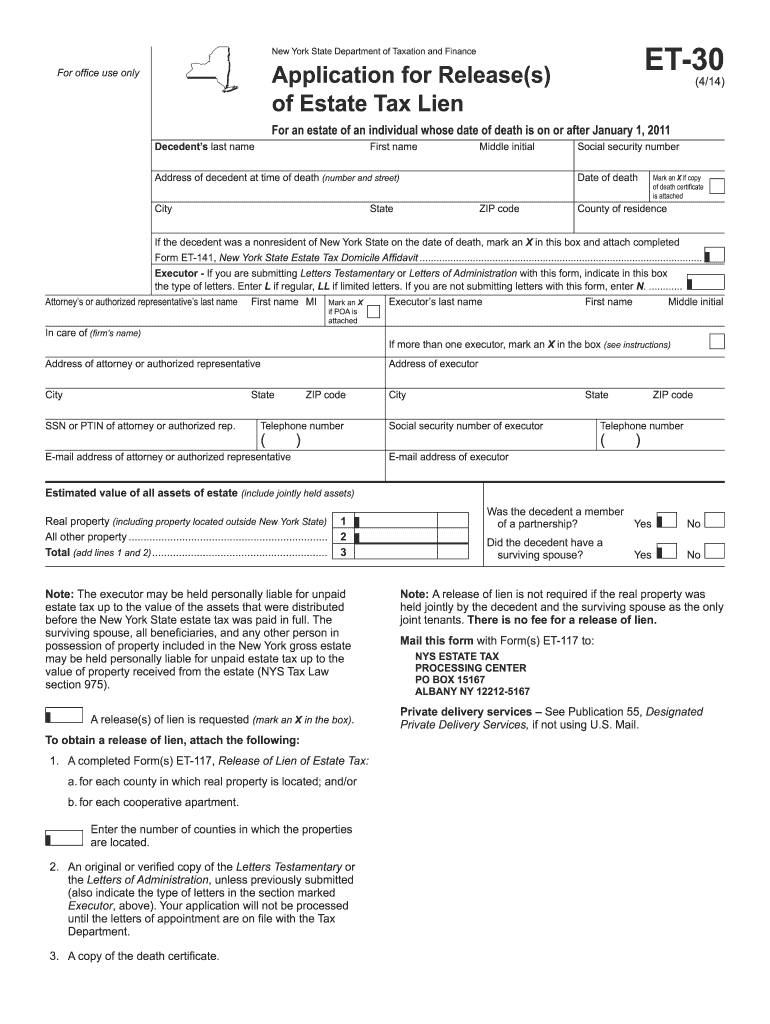

Portability is a provision in. Exemption forms and applications. Understand the Unified Tax Credit and the Upcoming Changes.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use. As the estate tax exemption amount increases fewer estates are subject to the federal tax.

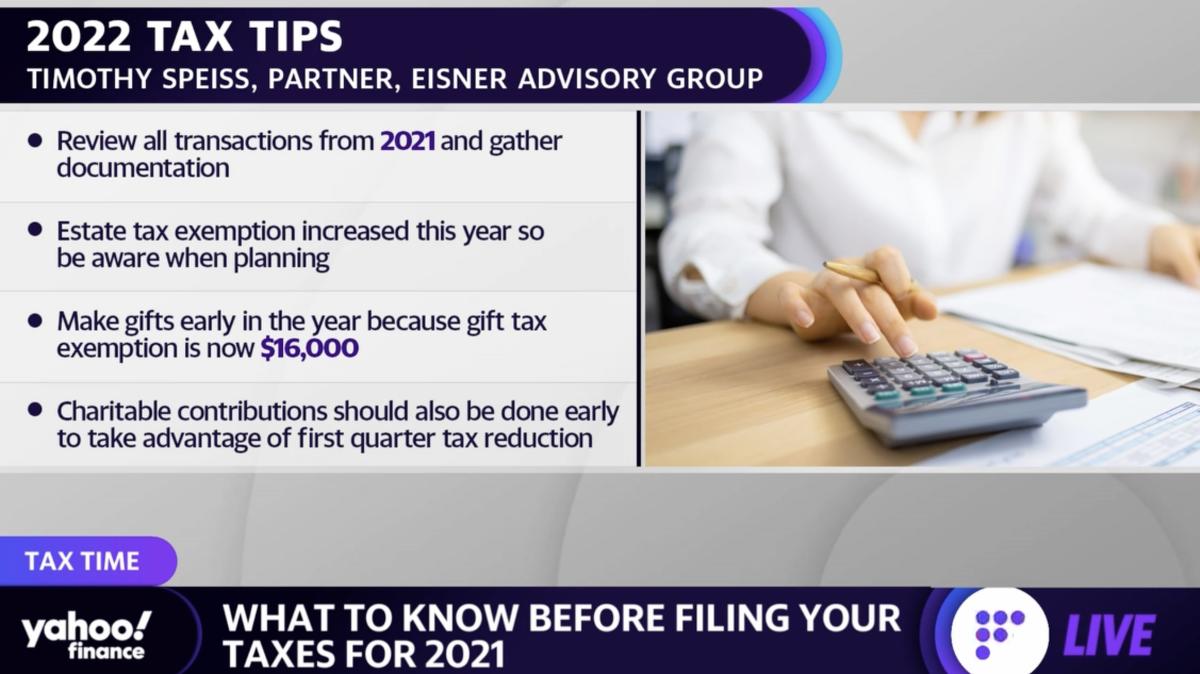

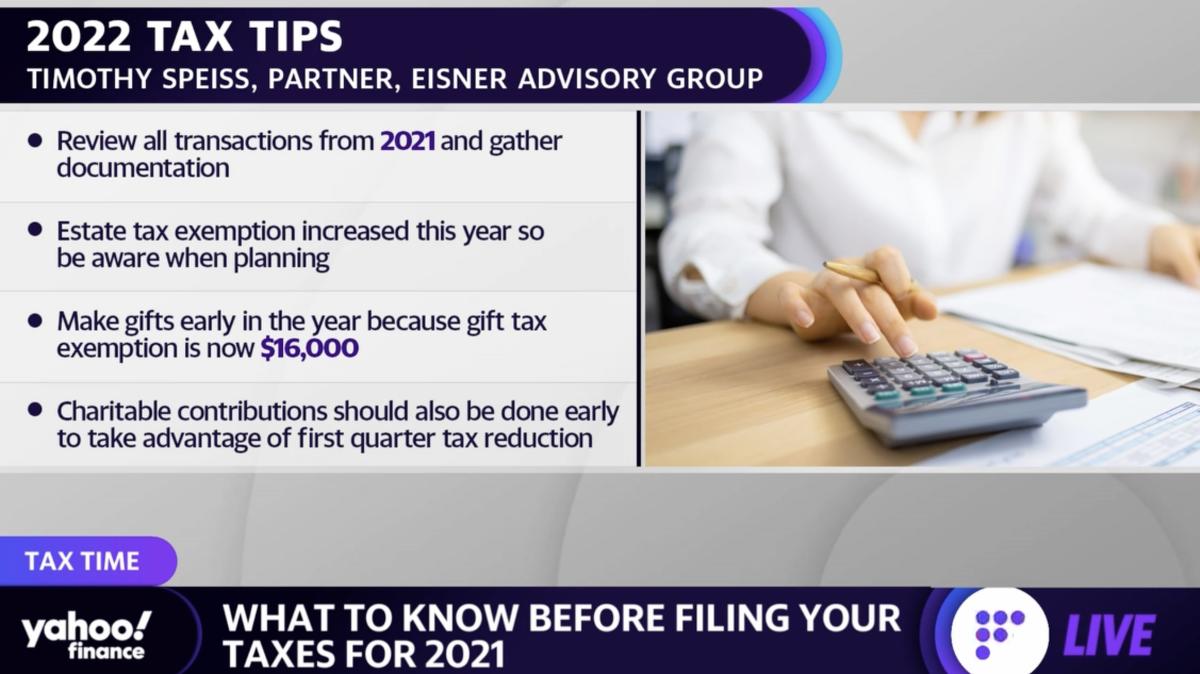

The federal gift tax exemption is 15000 per recipient per year for 2021 and 16000 in 2022. The IRS has announced the official estate and. The amount of the.

The New York States estate tax exemption for 2022 is 6110000 million. To illustrate how the NY estate tax works consider the following example. What does filing for portability mean.

The above exemption amounts were determined using the latest data available. The current estate tax exemption is 12060000 and double that amount for married couples. 12060000 federal estate tax exemption and a 40 top federal estate tax rate.

A nurse is reviewing the ecg rhythm strip of a client who is receiving telemetry. New York has an estate tax exemption of 5930000 for 2021. Phillips on November 14 2022.

In this instance the estate. The assets may include real estate cash stocks or other valuable items. Income taxes are bad enough but then you have to consider estate taxes.

For a married couple that comes to a combined exemption of 2584 million. Thankfully less than 1 of Americans will have an estate tax issue. The New York State Basic.

As you might guess only a small percentage of Americans die with an estate worth. These exemptions are subject to change as more. Nobody likes taxes.

When someone dies money that goes to. 20222023 Estate and Gift Tax Update. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application.

A New Yorker dies in January 2022 with a taxable estate of 6440000. New York Estate Tax. Posted in Federal Gift Estate and GST Tax.

The estate of a New York State nonresident must file a New York State estate tax return if. For 2022 the annual exclusion is 16000. New York Estate Tax for Married Couples.

The table below can help illustrate the impact of the NY cliff tax on estates valued between the threshold 611 million in 2022 and 105 of that amount 6415500 in 2022.

Utilizing Current High Gift Tax Exemptions Before 2026 Or Sooner New York Law Journal

Avoiding New York S Estate Tax Cliff Yorktown Ny News Tapinto

U S Gift Tax Exclusion Increases In 2022 Ny Estate Planning Lawyers

A Guide To Estate Taxes Mass Gov

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

It May Be Time To Start Worrying About The Estate Tax The New York Times

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

The Wealthy Now Have More Time To Avoid Estate Taxes

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How To Mitigate The New York Estate Tax Cliff Wealthspire

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How To Avoid The New York Estate Cliff Tax

Taxes 7 Tips To Prepare For The 2022 Tax Season

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

What Is The New York State Estate Tax Cliff Russo Law Group

Do I Have To Pay A New York Inheritance Tax If My Parents Leave Me Their House Long Island Ny Estate Planning Attorneys